As investors of all stripes seek to maximize their returns, traditional models no longer offer strategies that take best advantage of favorable market forces and fuel necessary (and expected) growth. Contemporary, innovative perspectives on risk and portfolio allocation broaden the available options for investors and increase the possibility of stronger returns.

The model that forms the foundation of how best to divide the assets in an investment portfolio comes from Modern Portfolio Theory (MPT), the brainchild of economist Harry Markowitz (and others) that dates back to a 1952 paper describing a system for assembling a portfolio of assets maximized for a given level of risk. Its key insight: Don’t weigh an asset’s risk independently; rather, look at how it contributes to the portfolio’s overall risk.

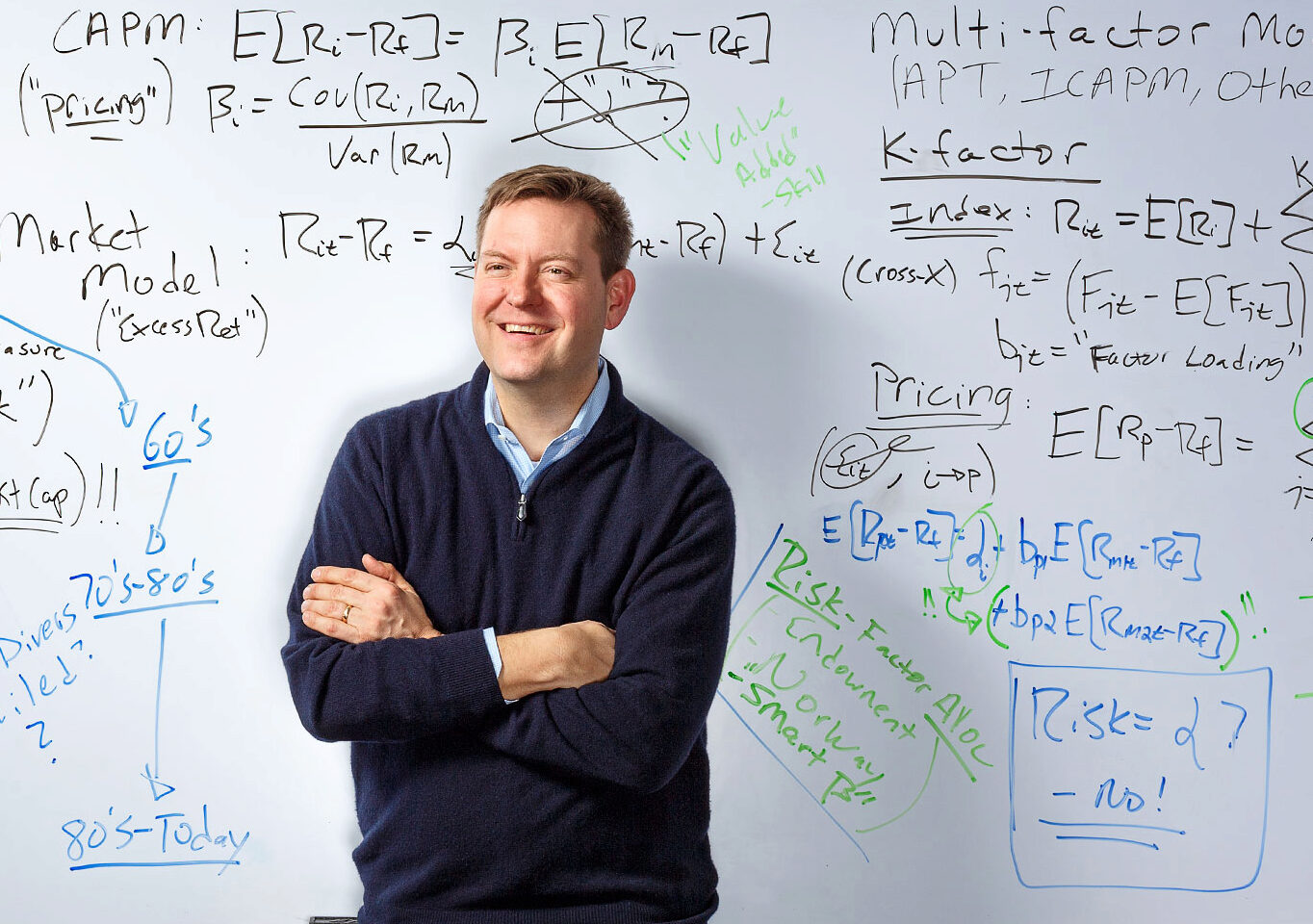

Thanks to the influence of MPT, investors likely recognize and perhaps adhere to the classic 60/40 allocation standard for a well-diversified portfolio, with 60 percent composed of stocks and 40 percent in bonds. But while traditional models in 1961 forecast returns of 9.1 percent, “today, most are expecting four percent to five percent,” says Chris Geczy, who directs the Jacobs Levy Equity Management Center for Quantitative Financial Research at Wharton. With the traditional model’s utility at a low point given the expansion of new asset classes and investment opportunities, institutional investors in particular — charged with garnering strong returns for retirements, pensions, and endowments — are looking for alternatives with an eye to unique opportunities.

Today’s MPT broadens the slate of choices for investors and creates a framework for how best to allocate assets, thanks in part to expansions in theory and investing practices. The new scheme has the following key aims:

- Seek more risk and diversify across it.

- Pursue higher returns by leveraging up a better-diversified portfolio, or by concentrating on higher-risk assets like small caps, real estate, or venture capital.

- Don’t sacrifice diversification for concentration in equities or assets that may be exposed to the same risks or losses at the same time.

But diversification is not dead, according to Geczy. It’s simply shifting from asset-based allocation to a risk base.

Alternative Investments at Wharton is developing a curriculum — including undergraduate and graduate courses as well as a Wharton Executive Education program — to arm fund managers with the skills to evaluate their investments with greater knowledge of risk and value. With the help of cutting-edge faculty research, investment professionals can make decisions that best support everyone, from working families to retirees to neighborhoods and communities around the world.