May 2023 • Edition 21

This month, join Wharton Impact in celebrating the commitment of Steven Silverstein, WG’85, to steering retail business to do good for society; the expansion of financial aid for Wharton undergraduates; and the MBA students who participated in an impact investing competition sponsored, in part, by Bobby Turner, W’84.

Retail With Purpose: The Business of Doing Good

Every year, Spirit Halloween banners appear in storefronts like so many sprouting pumpkins: the company has grown since 1983 to become the largest Halloween retailer in North America. Less visible, but no less magical, is the company’s philanthropic arm: led by CEO Steven Silverstein, WG’85, the firm has raised millions for charity, and employees routinely volunteer at children’s hospitals on Halloween. A new gift from Silverstein will transform the study of retail at Wharton.

Financial Aid Expands for Wharton Undergraduates

Since the 1960s, the inflation-adjusted cost of a college degree has nearly tripled. But a Wharton undergraduate degree is now more accessible: President Liz Magill recently announced an expansion to undergraduate financial aid, which will allow more students to qualify for scholarships that cover the complete cost of a Penn education.

Competing to Make a Difference

When she arrived at Wharton, Anty Chen, WG’24, knew she wanted to make an impact — she just didn’t know how. Having volunteered at a composting startup in Brooklyn, she had seen the power of impact investing. And at Wharton, she had no shortage of courses on topics like Environmental, Social and Governance investing. But what would it look like to leverage those skills as a professional investor?

“I really wanted some real-life experience with impact investing,” Chen recalls. “I wanted the whole spectrum of skills that an impact investor would use, including sourcing, client due diligence, and pitching — both the soft and hard skills.”

Fortunately, Chen found the Turner MBA Impact Investing Network and Training (MIINT) competition. Now in its twelfth year, the competition, a partnership between the Bridges Impact Foundation and the ESG Initiative at the Wharton School , affords MBA students worldwide the chance to try their classroom skills in a real-world environment. “It’s not a simulation,” says Chen. Just like their professional counterparts, participants research firms, then pitch one company to an investment committee. In March, over 450 students participated in the competition, which took place in-person for the first time since 2019.

For Chen — and for her classmate Masaki Goto, G’24, WG’24 — the experience proved invaluable. “I reached out to companies in Kenya, in Morocco, in Egypt,” Goto recalls. “Post-MBA, I’m interested in impact investing, so I really learned a lot about what I need to do.”

“It’s so important to build that network of professionals, peers, and mentors,” says Chen, “who are passionate about empowering the world and ensuring that we have a world in the future.”

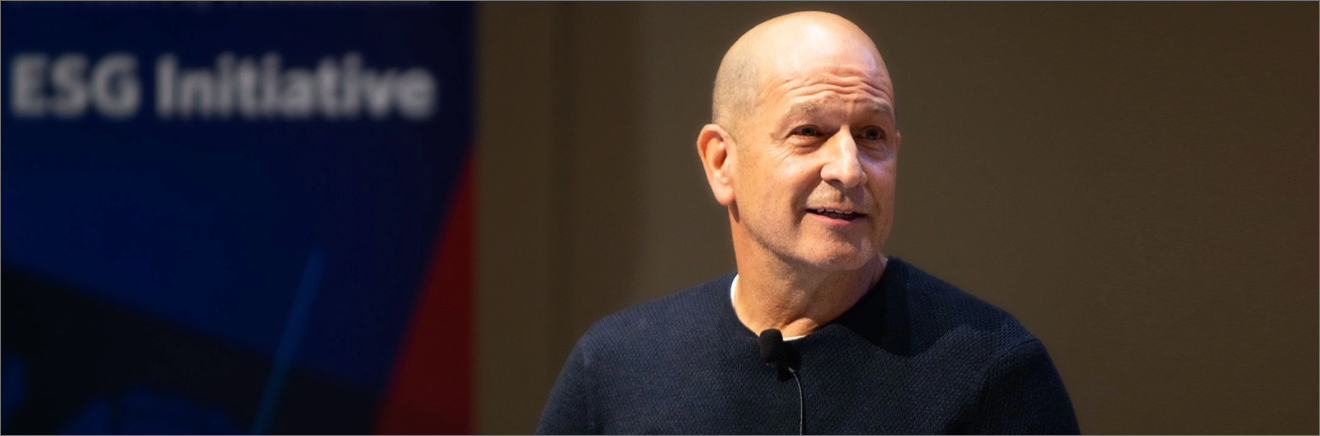

The competition is made possible, in part, by the generosity of Bobby Turner, W’84, the founder of Turner Impact Capital and one of the prime movers behind Wharton’s own ESG initiatives, who recently spoke with Wharton Magazine about the growing importance of impact investing.